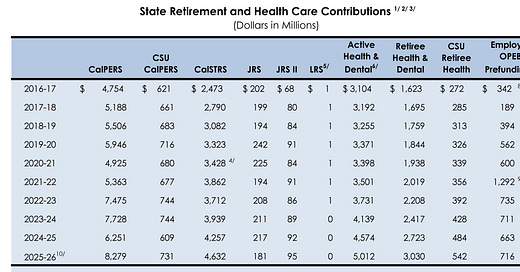

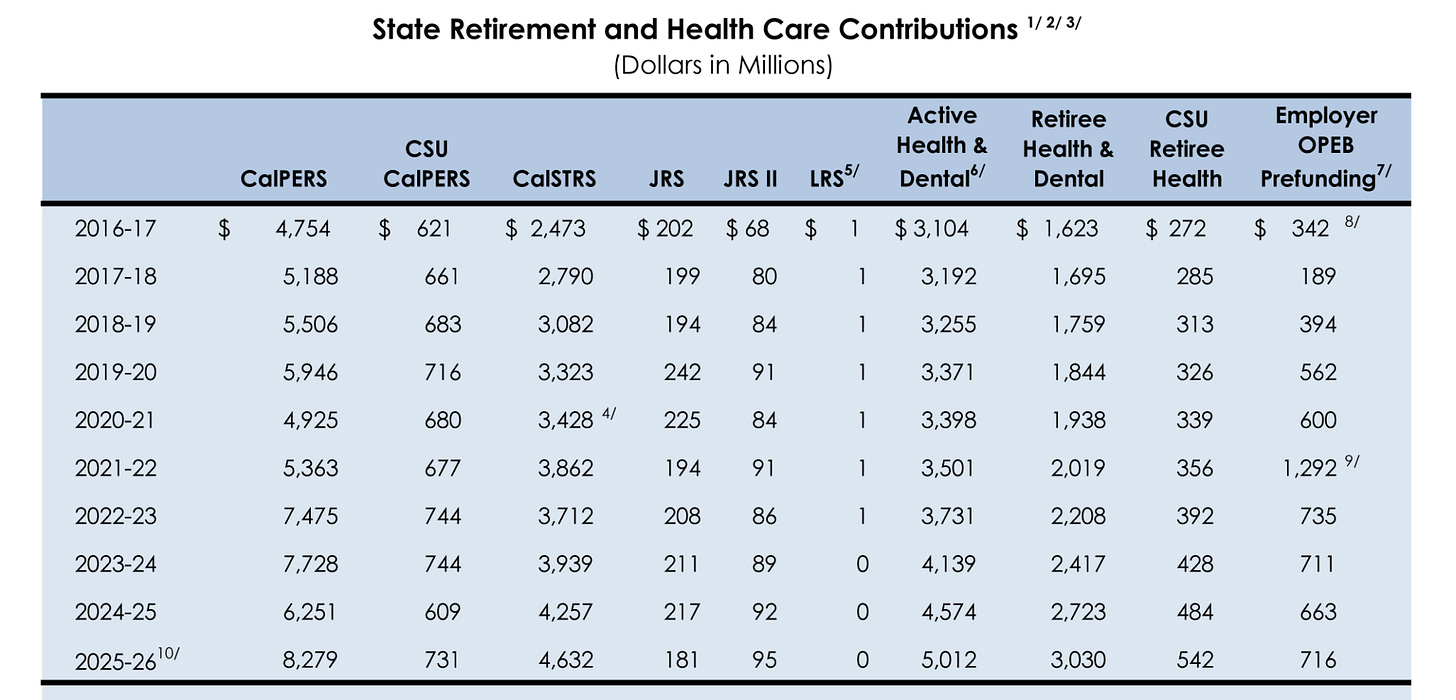

CA’s Department of Finance discloses the state’s spending on pensions and other retirement costs in this chart, which (not including the Active column) adds up to $138 billion of retirement spending over the ten years shown there:

$138 billion is more than twice the $64 billion the state spent on retirement costs the previous 10 years. But that’s not all. Underneath the chart are footnotes, one of which discloses that the chart does not include supplemental spending:

After reviewing Annual Comprehensive Financial Reports and Schedules of Debts and Liabilities Eligible for Payments Under Proposition 2, you would learn that, since 2017, taxpayers have spent a supplemental $26 billion on retirement costs. That lifts the 10 year total to $164 billion, 2.5 times the state’s spending on retirement costs the previous 10 years.

The principal cause behind the sharp increase in retirement spending is unfunded liabilities that have been — and continue to be — deliberately created by pension fund boards and elected officials at the urging of public employee unions. To add insult to injury, public employee unions also hijacked a 2014 ballot measure (Proposition 2) to require taxpayers to make supplemental payments in respect of their self-crafted unfunded liabilities. For taxpayers it’s a vicious cycle.

While cities and counties can discharge debts by declaring bankruptcy, under current law states do not have that option. Unless elected state officials elevate the interests of taxpayers above those of public employee unions, there’s no end to the cycle in sight.